News and Events

national

Hoping to get your foot on the property ladder, or invest, but not sure what's the best type of property for you?

Understanding which property option is best for you can be confusing. We have explained some of these choices in more detail below. Some possibilities that you may be considering are:

Buy land and then build your dream home

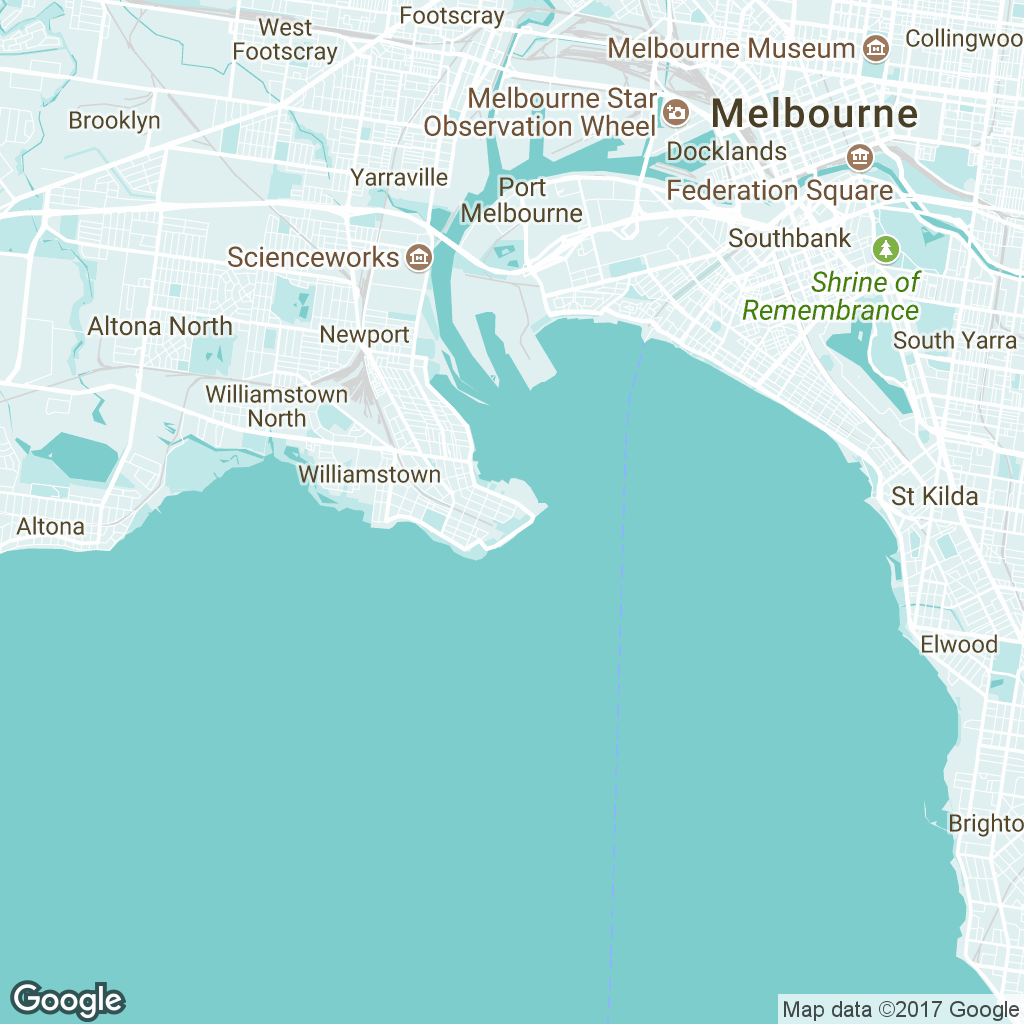

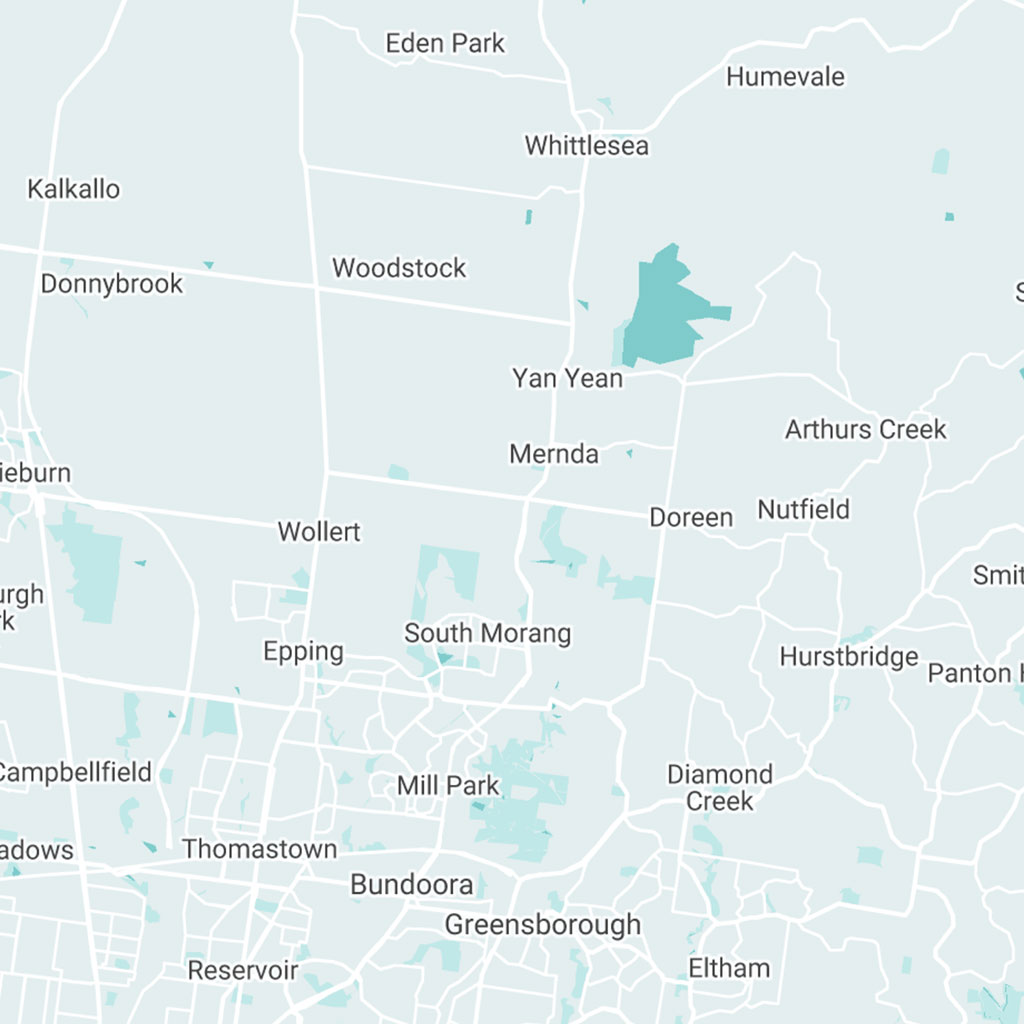

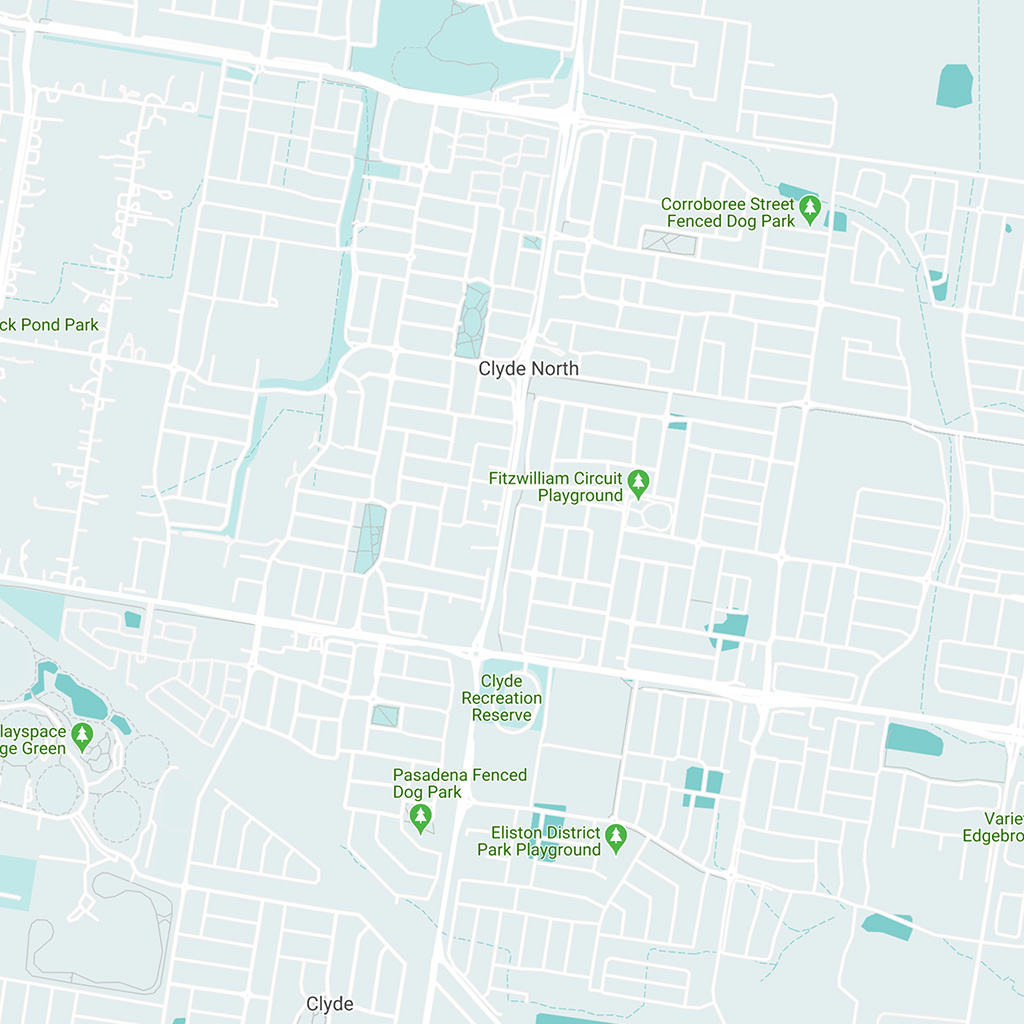

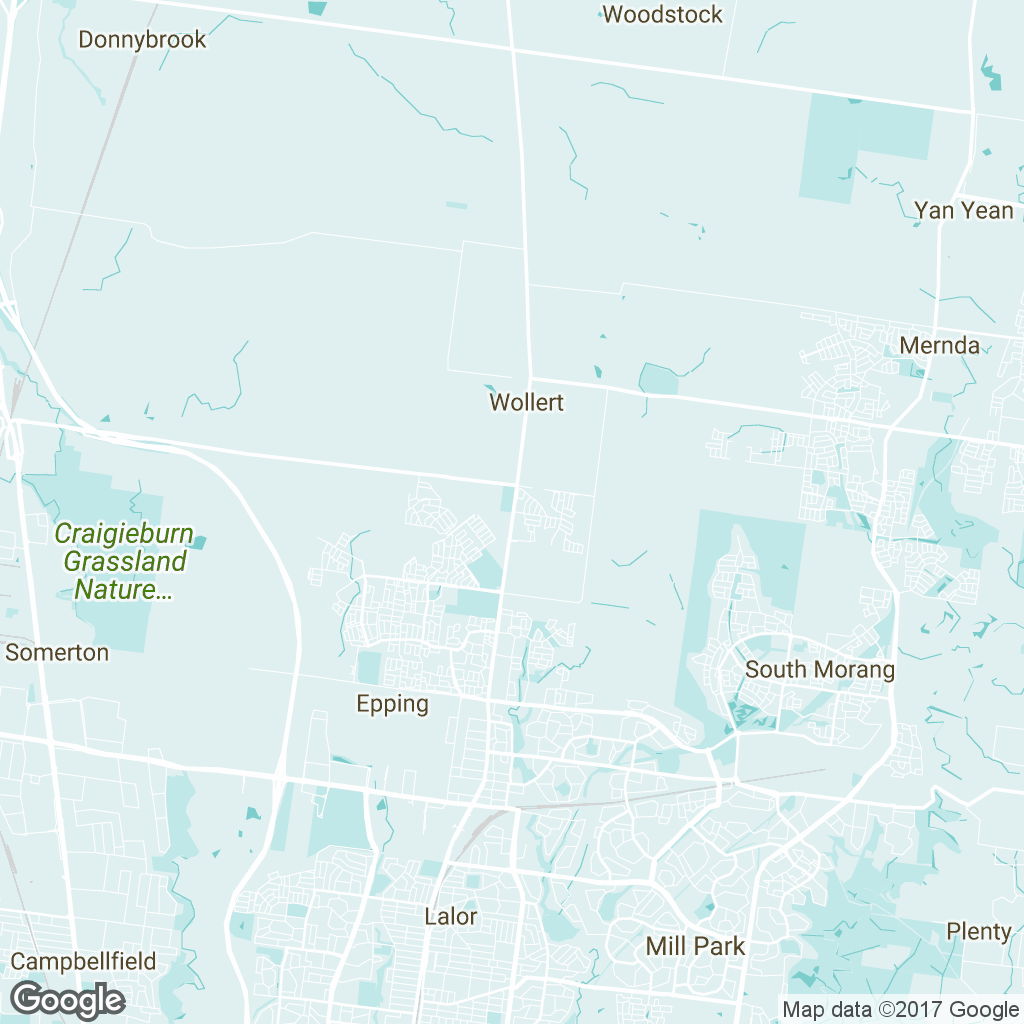

Buying land in a new suburb can often be more affordable than buying in established areas. Choosing your own block of land gives you the ultimate flexibility. You can choose the exact block of land you like in the location you want and then decide on your dream home. Choose the home design that will meet your needs now or in the future and appoint your own builder.

To see if we have a block of land that suits you click here.

Handy tip: Visit display villages to get some home design ideas and work out what size of a block you need to fit your perfect home or choose a house and land package.

Buy a home or apartment off the plan

Buying off the plan is one of the easiest ways to enter the property market. Buying a home or apartment off the plan means entering a contract to buy the property before it is built. Apart from eventually moving into a brand new home, this option has many benefits such as:

Locking in today’s purchase price. Often a 10% deposit is required to secure an off the plan purchase. Typically, no further payment is required until the property is constructed and complete. This not only secures today’s selling price, but it also gives you plenty of time to save and get your finances in order.

Tax Depreciation. If you’re considering purchasing as an investor, buying off the plan can provide some tax benefits by being able to claim depreciation on your property, fixtures and fittings.

Stamp Duty Benefits. By purchasing off the plan, some state governments offer deferred stamp duty payment or stamp duty concessions for those people planning on living in the property. Visit your state government or state revenue office website for more information.

Click here to see our latest properties that you can purchase off the plan.

Buy a new, ready to move into home

Buying a new, ready to move into home is also known as a ‘turn-key’ or ‘ready built’ home. This is the fastest way to move into a brand new home.

As the name suggests, ‘turn-key’ literally means that all you have to do is turn the key and move in! Key benefits are:

- Peace of mind. A ready built home provides certainty over the finished product and inclusions. What you see is what you get.

- A fixed price. This option takes the stress out of hidden costs with no nasty surprises like extra site costs or additional building costs. With no progress payments you pay the fixed amount once your home is ready to move into.

- Everything is included. This is the easiest way to move into a brand new home. Pre-selected by design professionals, everything has been taken care of for you including colour selections, fixtures and fittings, flooring, landscaping and fencing.

- Your home will be ready to live in. With a ready built home, you won’t have the hassle of waiting for the finishing touches of your home to be completed or need to wait for things like your driveway to be done. All you need to do is turn the key and start enjoying your new home straight away!

See our video on the benefits of moving into a turn key home.

Click here to browse our selection of turn key homes and townhomes for sale now.

Buy an established home

Buying an established home means you are more likely to be buying into a suburb closer to a city centre that is supported by established infrastructure, parks and public transport.

This option offers the convenience of being able to choose an established neighbourhood that is close to your work, desired school or friends and family. However established homes are unlikely to have the exact floorplan that you would like and will often require further work or renovations. Older homes also generally require more upkeep and maintenance.

First home buyers may not be eligible for grants or assistance when purchasing older homes in some states. Visit your state government or state revenue office website for more information.

Always make sure you receive independent financial or legal advice before purchasing a property.